Emporia State University is planning to update students on the policies and procedures associated with President Joe Biden’s announcement Wednesday to forgive or pause student loan debt. However; it’s unclear at this time when that information may be readily available to disseminate.

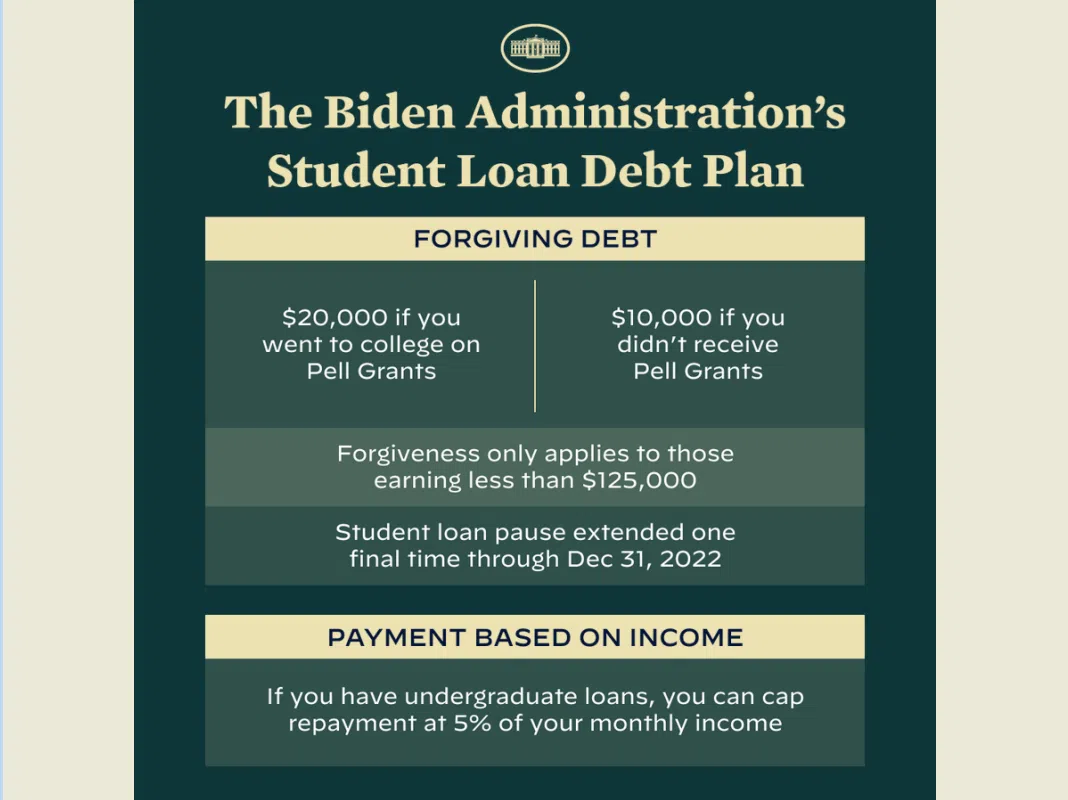

Biden’s announcement included details such as how much can be forgiven. Current indications are students who went to college on Pell Grants could receive up to $20,000 in forgiveness while students who did not could receive up to $10,000 in forgiveness.

Forgiveness will also be available for students who currently make $125,000 a year. What is unclear at this time is exactly how students will be able to access this forgiveness.

Emporia State University’s Office of Financial Aid says it is expecting a rash of phone calls seeking this information and is asking students to withhold those phone calls for the time being as it awaits further details. It’s unclear when those details will be announced, however, ESU says the information will likely come from the US Department of Education and could be in hand as soon as Friday at the earliest.

Regardless of when the information is made available, the university says it will keep students informed and up-to-date as the situation unfolds.

KVOE has also reached out to Flint Hills Technical College for comment on the loan forgiveness plan.

Stay with KVOE, KVOE.com and KVOE social media for more information as it becomes available.

11 am Wednesday: President Biden announces plan to forgive or pause student loan debt

President Joe Biden has announced his plan to forgive or pause student loan debt.

Biden’s multifaceted plan includes forgiving up to $20,000 in debt if students went to college on Pell Grants and up to $10,000 if they didn’t. Forgiveness applies for students earning less than $125,000.

The current pause on student loan repayments will be extended through New Year’s Eve.

Repayments can be capped at five percent of monthly income for students with undergraduate loans.

ABC News says one-third of federal loan borrowers have less than $10,000, meaning they could see their debts completely wiped out should this policy come to fruition. Another 20% of borrowers, around 9 million people, would have their debt at least slashed in half.

Biden could enact the policy without Congressional approval, but he could be sued by members of Congress. Loan servicing companies could also file lawsuits if Biden bypasses Congress.